August 26, 2020

In the digital world,

leaders must master the art of competitive resiliency

What if everything you were taught about creating and sustaining competitive advantage is no longer true?

Most leaders of well-established businesses were taught that the key to creating sustainable competitive advantage was erecting large barriers to entry into their markets by scaling the size and reach of their companies. The reason this approach was successful was the high costs incurred to:

- Build product development and manufacturing capabilities

- Create sales, marketing, and customer service networks

- Fund hardware and software technology expenses to manage Data Centers, ERP, CRM, Finance, and HR systems

- Allocate significant resources and investment to R&D

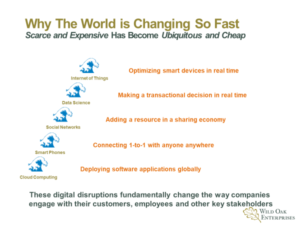

As the past decade’s onslaught of multiple waves of digital technology disruptions have shown us, what was once scarce and expensive is now cheap and ubiquitous as shown on the chart below:

Traditional competitive stalwarts like GE, HP, Kodak, Nokia, Merrill Lynch, Bethlehem Steel, General Foods, and many others are now either a shadow of their former selves or gone entirely. Whether they got stuck defending the fort or failing to catch the next wave, what they all had in common was a lack of competitive resiliency. One way to think about resilience is a measure of how much disruption a company can absorb before it breaks down so fundamentally that it can no longer return to what it once was. Simply put, resilient companies have the ability to make quick corporate pivots.

The new competitive paradigm is about resiliency not sustainability

To be a resilient company you need to be able to withstand unexpected changes and shocks and be able to walk away with the core attributes of your competitive strategy intact. That doesn’t mean you rigidly cling to your current business model, but it does mean that you need to develop a process of adaptive strategic thinking that enables the company to reconfigure itself when necessary. Business transformation, as I have written about in earlier blogs, is about continuously realigning how your company creates and delivers value to your customers.

Here are four questions you can use to assess your company’s current state of competitive resiliency:

- How resilient is your business model?

- How resilient is your leadership team?

- How resilient is your company’s culture?

- How resilient is your customer loyalty?

Resilience needs to be built into the way your company thinks and acts in advance, like a strong immune system before the pandemic strikes. In practice, this means using tools like scenario planning and systems of intelligence to identify potential competitive threats and then think through how you would address them. Rather than narrowing potential threats, a management approach based on resilience would emphasize the need to keep options open. Successfully resilient companies develop the ability to reconceptualize problems and generate a diversity of ideas to deal with them.

Competitive resiliency is about privileging long term market power over short term performance

In a time of unprecedented change and disruption, it’s easy to just focus on the short-term problems of the day to preserve what you have and survive to play another day. The big “aha” moment for senior leaders occurs when they realize that while power generates performance, performance consumes power. This means that if the company continues to overweight investments in current businesses to deliver short-term performance, it will eventually liquidate the company’s long-term power to grow.

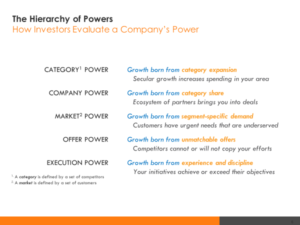

To build a path toward competitive resiliency, leaders need to make a compelling case for freeing their company’s future from the pull of its past. My brother, Geoffrey Moore, has developed The Hierarchy of Powers framework to help leaders achieve that outcome as shown on the slide below.

This market proven framework enables senior leaders to evaluate the company’s long-term power to grow at five different levels. Each level amplifies the tradeoffs between investing in short-term performance vs. long-term power.

In my September blog, I will go into greater detail about each level and how they are utilized.

As always, I am interested in your comments, feedback and perspectives on the ideas put forth in this blog. Please e-mail them to me at here. And, if this content could be useful to someone you know please share it here: