February 21, 2018

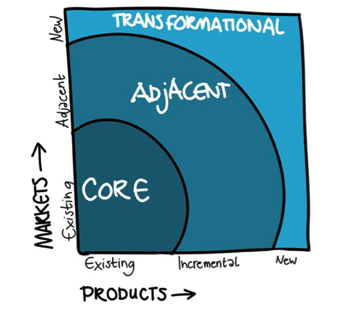

In the new digital world,

technology will drive companies into

adjacent industries and new businesses.

The Harvard Business Review conducted a five-year study of corporate growth involving 1,850 companies. The study reached two major conclusions:

- The most sustained, profitable growth came from companies that pushed the boundaries of their core business into adjacent space.

- Companies consistently and profitably outgrew their competitors by expanding those boundaries in predictable and repeatable ways.

The emergence of new waves of digital disruption including cloud, mobile, social, data analytics and smart devices exponentially broaden the role of technology in creating multiple pathways to adjacent industries and new businesses.

The challenge for any well-established company

The majority of successful well-established companies struggle to find the right balance point between funding their current businesses and making significant investments in next generation businesses that will deliver material new revenues, margins and profits.

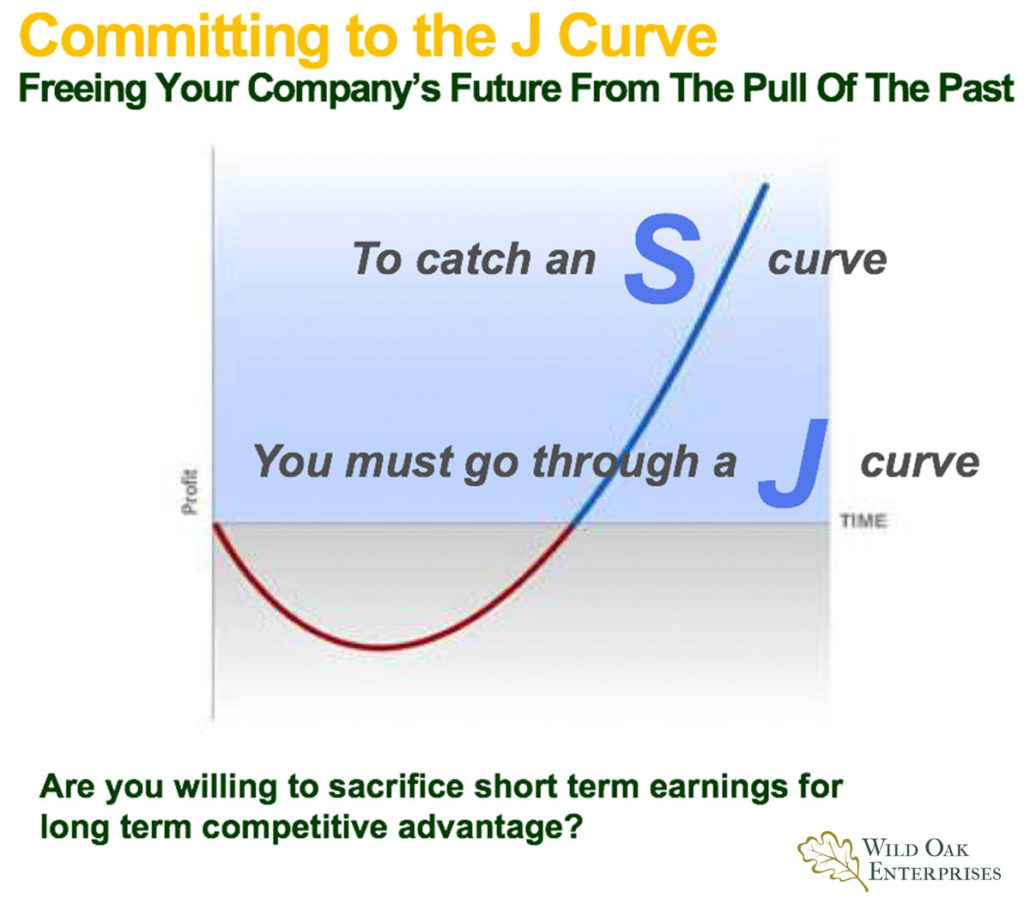

What makes it so hard for these companies is they need to sacrifice short term revenue and earnings results in order to redeploy scare resources and funds to these adjacent industries and new business opportunities. Venture capitalists call this investing in the J Curve to catch the S Curve as shown below:

To overcome these conflicting priorities, requires strong leadership, the resolve to stay the course and a willingness to deliver lower short-term results to create higher sustainable long-term growth.

Asset deployment vs. Asset ownership

Historically companies believed that owning assets was the key to creating sustainable competitive advantage and building high barriers to entry into their markets and industries. Today as Uber and Airbnb among others have taught us, deploying digital technology with its widespread connectivity to leverage existing underutilized assets is the new business model for profitable growth. Without having to spend their capital to own assets, they can access and deploy incremental adjacent assets at minimal marginal costs.

In addition, replacing high cost physical assets like data centers with pay as you go web services from Amazon, Microsoft or Google can dramatically lower the cost of entry into adjacent industries and new businesses.

Utilizing this new business model approach also opens up opportunities for companies to start offering their products as subscription services such as:

- Gillette On Demand & Dollar Shave Club

- Spotify, Netflix and Hulu

- Adobe, Salesforce & Workday

- Atlas Coffee Club, Stitch Fix & Hello Fresh

The subscription e-commerce market has grown more than 100 percent a year for the last 5 years.

Getting started: Build an outside-in market centric perspective

In his earlier book Escape Velocity – Free Your Company’s Future From The Pull Of The Past, my brother Geoffrey Moore, developed a framework and toolset to enable senior business leaders to conduct a series of thoughtful discussions on how best to deliver material revenues and profits from adjacent categories and new businesses.

Here are some questions to get those discussions started:

- How much competitive advantage does your company have in each of its current businesses?

- How sustainable is your current market share?

- How strong is your pricing power with customers?

- How committed are your supply chain partners to your company?

- How can your company effectively leverage digital technology to enter adjacent markets and businesses?

- How can the company deploy systems of engagement to enter adjacent markets?

- Who will design and develop your next generation of offers?

- For whom will they be designed and developed?

- How can the company utilize systems of intelligence to evaluate adjacent market and new business opportunities?

- Who will be your new reference competitors?

- How will you be able to differentiate against these competitors on a sustainable basis?

- How can the company deploy systems of engagement to enter adjacent markets?

- How capable is your company of competing as a digital enterprise?

- How will you develop or recruit the relevant skills and capabilities needed to compete?

- How will you incent achieving long term growth while sacrificing short terms results?

- How can you partner with other companies to enter adjacent markets?

How some companies have used technology to get into adjacent markets and businesses

John Deere expanded from its core base of manufacturing farming machines into developing software tools and machine learning algorithms that analyze soil conditions, weather and herbicide use to enable farmers to more cost effectively increase their crop yields.

France’s La Poste is using data analytics to identify new market opportunities for their postal delivery infrastructure and services including elder care and food delivery.

UST Global is partnering with a healthcare company to develop an IoT device to be used in cars. When the “digital stethoscope” is integrated with the car’s seatbelts, it monitors the driver’s health in real-time so if they have a life-threatening episode it automatically parks the car and calls an ambulance.

CVS recently made a $69 billion offer to acquire Aetna which would join the world’s largest pharmacy retailer with one of the largest health insurers. The merged company would enable CVS to position their 10,000 plus stores as full-service community clinics that deliver advice, tests, ongoing care and insurance products. It also gives them direct access to Aetna’s vast customer data base.

Apple & Cisco have teamed up with insurer Allianz SE to offer discounts on cyber insurance to businesses that primarily use equipment from both technology companies. The arrangement, which also includes insurance broker Aon Plc, makes customers eligible for more favorable terms of cyber coverage such a lower or no deductibles, as well as, support services in the event of an attack.

Standing pat is not an option

As comforting as it may seem, sticking with the hand you’ve been playing is no longer a competitively viable option in the new digital world. Digital technology is disrupting every facet of how companies engage with their customers, employees, supply chain partners and other key stakeholders. As such, the new competitive imperative is how will your company make select asymmetrical investments in adjacent markets and new businesses that will generate material new revenues, margins and profits. The good news is that there are frameworks, models and tools to help guide you along this new path. Let me know, if you’d like to learn more about them.

As always, I am interested in your comments, feedback and perspectives on the ideas put forth in this blog. Please e-mail them to me at pdmoore@woellc.com