October 25, 2023

In the digital world,

innovation capital is the new currency of success

Is Innovation a strategic priority or an afterthought in your company?

The myriad of new disruptive digital technology innovations have raised the leadership bar for success. Companies can no longer pay lip service to innovation as an addendum to their business growth strategy if they want to compete as viable digital enterprises.

Leaders from the C-Suite on down throughout the organization now have to cultivate and develop their innovation leadership skills to influence others to support funding and development for next generation products, services, and new businesses ideas.

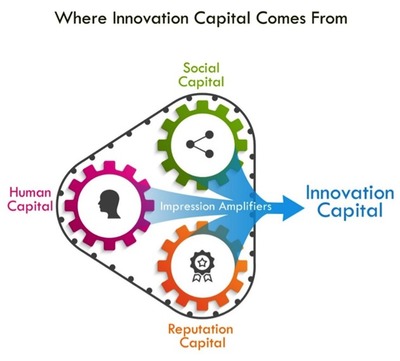

A research study from the Harvard Business Review identified and measured four essential leadership qualities as proxies for creating innovation capital:

- Personal reputation for innovation – who you are

- Social connections and networks – who you know

- Track record for value creation – what you are known for

- Investor expectations for future value creation – innovation premium

Cultivating and developing these leadership qualities and leveraging them to deliver market leading value creation and customer experiences is very hard work. It requires an open-minded, forward-thinking approach to new ways of doing things combined with an ability to make innovation part of an organization’s cultural DNA.

As Marc Benioff, CEO at Salesforce, says “I can’t do it all. I don’t have all the ideas. That isn’t my job. My job is to build a culture of innovation. That’s something that we try to enforce. We encourage it. We value it. We notice it. We compensate for it. We require it.”

Building a path to the future starts with letting go of the past

The only thing harder than predicting the future is building a successful path to it. In KPMG’s Global CEO Outlook survey of 400 CEOs they documented these results:

- 85% admit vulnerability about the amount of time they spend strategizing about forces of disruption and innovation

- 80% are concerned that their existing products and services will not be relevant in 3 to 5 years’ time

- 70% believe their organizations’ cultures do not encourage risk-taking and safe-to-fail environments

As my brother, Geoffrey Moore, documented in his book Escape Velocity, most companies struggle to free their future from the pull of their past. The single biggest challenge facing CEOs and other C-Suite leaders in well established companies is how to find the right balance between funding the businesses they have versus making significant enough investments in next generation businesses so they can deliver material new revenues and profits. Microsoft’s extraordinary business model transformation provides a compelling example of the exponential benefits of letting go of your past.

As I’ve written about in previous blogs, when Satya Nadella took over as CEO of Microsoft he embarked on a transformation initiative to reboot each of the companies core businesses from an on-premise, on-desktop business model to a cloud-first, mobile-first model.

When he prioritized the Cloud Azure business, it was showing modest growth potential competing with Amazon Web Services and was generating $5 billion in revenues. He set a three year revenue goal of $20 billion which Microsoft surpassed 9 months ahead of schedule. It’s stock price more than tripled in that time period validating the “innovation premium” the market gives to companies that can meet investors expectations for future value creation.

Satya believes “a leader must see external opportunities and the internal capability and culture – and all the connections among them – and respond to them before they become obvious parts of conventional wisdom.”

He has stated that there are three essential leadership attributes necessary to successfully build a new path forward:

- The ability to create clarity when none exists

- A knack for sparking energy

- An ability to succeed in an over-constrained space

A framework and process to increase your innovation track record for value creation

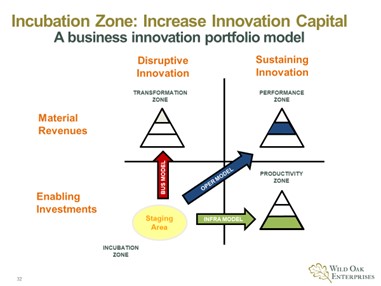

The hard truth for most companies is that well over 70% of their new product and business innovation investments generate little or no ROI. While there are numerous reasons given for this lack of success, I think it stems from not having a business innovation framework that distinguishes between different types of innovations and the outcomes they are designed to deliver as shown on the chart above.

Over the past six years, I’ve been working with senior business leaders and business innovation teams using this framework and process to prioritize and manage a portfolio of innovation projects. The key success factor has come from building a balanced portfolio of Sustaining innovations and Disruptive innovations that are aligned with the company’s business growth goals and financial metrics.

Each innovation initiative is first segmented using the following questions:

- Is it a Sustaining or Disruptive innovation?

- Is it enabling systems productivity and cost optimization? – Productivity Zone

- Is it increasing business unit performance and revenue growth? – Performance Zone

- Is it enabling a business model transformation? – Transformation Zone

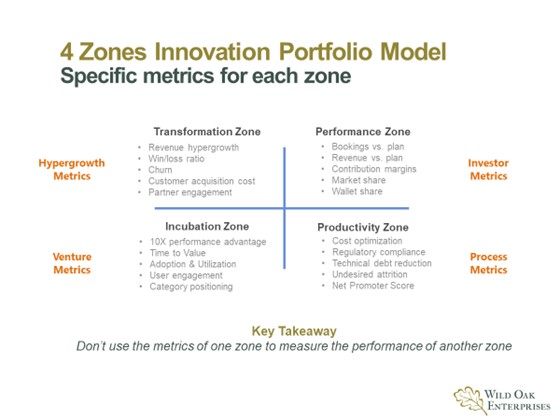

In addition, instead of using resource capacity and budgeting constraints to make prioritization decisions, we deploy the following three questions:

- Should we do it? Does it align with and support critical business outcomes?

- Can we do it? Do we have the relevant skills, capabilities, and tools to achieve the desired outcome?

- Did we do it? Do we have the right metrics to measure the achieved outcome vs. the desired outcome as shown on the slide below:

This new approach moves project prioritization decisions from a budget exercise to a business value creation exercise that leverages business innovation as the new competitive imperative.

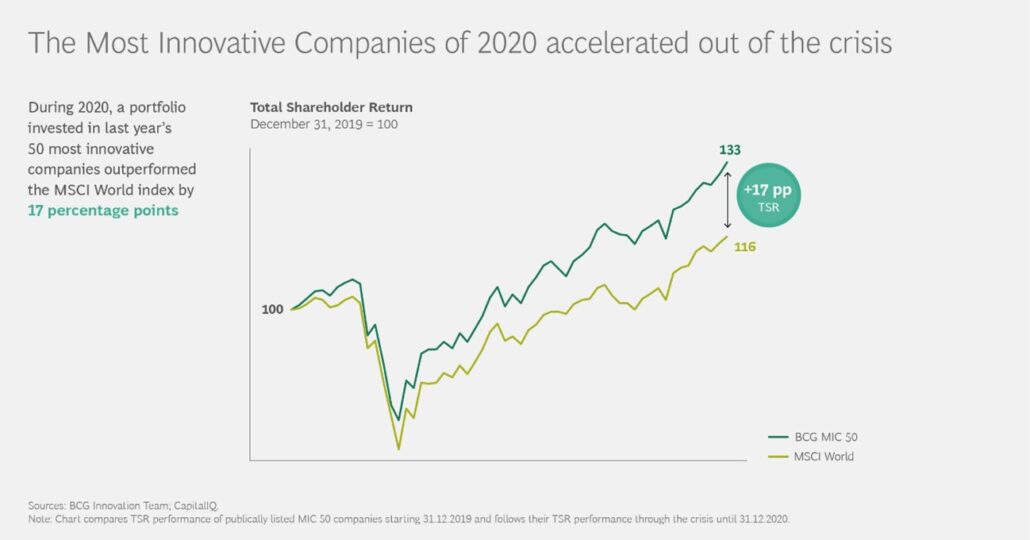

The market rewards sustainable value creation with an innovation premium

As shown on the slide above, Boston Consulting Group’s annual analysis of the 50 most innovative companies in 2020 showed that they outperformed the index by a staggering 17 percentage points in the past year—and even if you remove high-flying tech giants (Apple, Google, Amazon, Facebook, and Netflix), top innovators’ outperformance is still 13 percentage points.

A Harvard Business School study showed that leading digital technology innovation companies generate better gross margins, better earnings, and better net income than organizations that have not yet adopted a digital-first business growth strategy. Early digital adopters delivered a three-year gross margin of 55% vs. 37% for digital laggards.

The data and rewards the market gives to the most innovative companies clearly shows that innovation capital is the new currency of success.

|