June 24, 2020

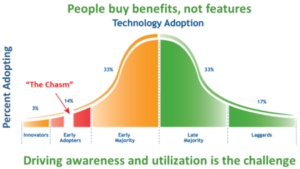

In the digital world,

it’s all about customer adoption & utilization

From buyer beware to seller beware

Historically, once a company sold a product or service to a customer, it was up to that customer to make sure they got their money’s worth. Now with the advent of “anything as a service” (AaaS), the burden of customer success has shifted back to the vendor. As I said in my May blog, in a consumption-based, subscription model economy customers no longer have to continue paying for products and services that don’t successfully deliver their desired experiences and measurable outcomes.

To attract and retain customers, companies have to shift their go-to-market playbooks from “closing a sale to opening a relationship.” As Amazon CEO Jeff Bezos says, “we see our customers as guests invited to a party, and we are the hosts.”

To create and sustain continuous customer relationships requires knowing how to get them to adopt and fully utilize your products and services.

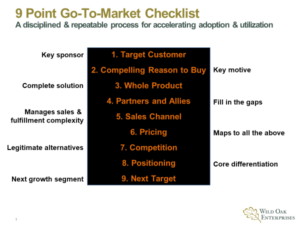

A 9-Point Go-to-Market Playbook to accelerate adoption & utilization

Over the past 15 years industry wide, new technology-enabled products and services have had a disappointing 17% success rate. Based on the work of Michael Eckhardt and our other colleagues at the Chasm Institute on over 500 client engagements during that time period, when companies successfully deployed the Crossing the Chasm 9-point go-to-market framework and analytics that success rate increased by 4x to over 70%.

The reason behind this 4x success rate improvement is the discipline and commitment to leverage a repeatable set of steps that accelerate customer adoption and utilization as shown in the 9-Point GTM checklist below:

Let’s take a look at each step, one at a time:

Step 1: Target Customer

What customer type has the highest desire or need for your product or service? At a minimum, there are three major types:

- Early Adopters & Visionaries who are motivated by a desire to buy ahead of the crowd for competitive advantage and personal “I’m first” bragging rights.

- Pragmatists who buy with the crowd and want a 100% whole product that helps them achieve their desired outcome or fix a critical problem they want resolved.

- Conservatives who buy after the crowd so they can get the best price/value outcome from adoption and utilization.

The biggest source of failure at this step is to treat the market as a horizontal opportunity which results in “spraying and praying” with the hope someone will respond.

Step 2: Compelling Reason to Buy

What are the major motivations (economic, technical, other) for this target customer to adopt your product or switch from another provider of the same product? What are the specific pain points that are causing them to seek a new solution?

- Early Adopters & Visionaries are more than happy to start with a minimum viable product (MVP) and provide input and feedback on how it can make their desired outcome even better.

- Pragmatists don’t use early adopters as reference customers as their desired outcome is very different than that type. They need to see fellow pragmatists who are trying to solve similar problems or achieve similar outcomes to theirs adopting and utilizing the product or service.

- Conservatives want to see multiple use case examples and be able to select the preferred provider, typically the market leader, as the one most likely to deliver their desired outcome.

The biggest source of failure at this step is to develop a single marketing and sales approach for all three customer types which does not recognize or appeal to their very different buying motivations.

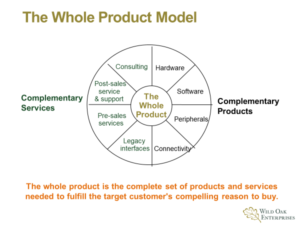

Step 3: The Whole Product

The complete set of products and services needed to fulfill the target customer’s compelling reason to buy as shown below:

The biggest source of failure at this step is to expect pragmatists to adopt something less than a 100% whole product or solution.

Step 4: Partners & Allies

What other companies or external resources are needed to develop and deliver the whole product or solution?

The biggest source of failure at this step is either to believe you have to build and own all elements of the whole product or not be able to successfully recruit partners and allies who are fully aligned with you (margins are consistent with each partner’s contribution) to deliver the desired customer outcome.

Step 5: Sales Channels

What sales channels (direct or indirect) will be used to engage target customers?

The biggest source of failure at this step is to assume that the sales channel that helped you win in an early market stage (direct, value added reseller, distributer, or other 3rd parties) will help you win again in a later life cycle stage. It truly depends on whether you are targeting the early adopter/visionary, the pragmatist, or the conservative each of whom has a distinctly different channel preference. The key to success is to remember it is the customer’s channel preference not yours that drives adoption and utilization.

Step 6: Pricing

What is the total price the customer will pay for the whole product or solution? How soon can the customer expect the product or solution to pay for itself? Does the pricing structure deliver?

- ROI win for the customer

- Financial win for the channel

- Profit for your company

The biggest source of failure at this step is assuming that all customers will find the same ROI period equally acceptable. As it turns out, Early Adopters & Visionaries often have a tolerance for an extended ROI period of 2 to 3 years, while Pragmatists and Conservatives expect a payback within 6 to 18 months, depending on the complexity of the solution. Misunderstanding these differing ROI expectations is a frequent error made by start-ups and well-established enterprises alike.

Step 7: Competition

Who are the direct and indirect competitors in this target customer segment that we must compete against? Is there a dominant competitor in the market? Is there a competitor who is trying to disrupt the market segment?

The biggest source of failure at this step is underestimating a customer’s loyalty to the legacy status quo, if provided by a powerful well-established competitor with greater than 40% share in the market.

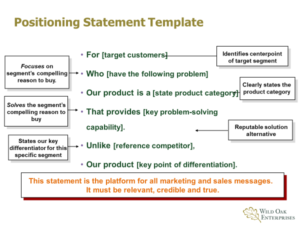

Step 8: Positioning Statement

The platform for all marketing and sales messages. It must be relevant, credible, and true. The following is the template we use to develop such a positioning statement:

The biggest source of failure at this step is creating a message that starts with you, the provider, and your solution as opposed to a more powerful and compelling message that starts with the customer and their problem.

Step 9: Next Target Customer

In which adjacent segment can we leverage our winning position from the original target market customer set? Does the next target market have the same or different motivation to buy your product or solution? Are we using the right playbook to engage the new target customer?

The biggest source of failure at this step is to assume an adjacency automatically exists between two segments – which is not always the case. An effective adjacency only exists if customers in the two segments have the same problem, are regularly in communication with each other, and reference each other before making buying decisions.

Successfully accelerating customer adoption and utilization of your products and services entails moving from a company driven sales model to a customer driven consumption model. The 9 Step Go to Market playbook provides a market proven discipline and set of repeatable steps that has delivered a 4x success rate improvement over traditional marketing and sales playbooks. If you would like to explore how it can help your organization achieve those kinds of results, please let me know.

As always, I am interested in your comments, feedback and perspectives on the ideas put forth in this blog. Please e-mail them to me here. And, if this content could be useful to someone you know please share it here: