April 29, 2020

In the digital world,

investing into a market downturn leads to exponential returns

Most senior leaders find comfort in believing that in times of severe market downturns cutting costs and hunkering down is a prudent course of action. The trouble is the data supports the totally opposite course of action.

One only needs to look back at the 2008 market downturn to see several compelling examples of the exponential returns a company gets when it invests into the downturn. New Constructs, a research house that measures a company’s return on invested capital (ROIC) used that metric to identify the top companies who outperformed the S&P 500 Index from 2008 until now.

As you might expect, Apple, Amazon, Facebook, Google and Microsoft significantly outperformed the index. But the company that caught my eye was Mastercard which had a cumulative ROIC of nearly 600% compared to 70% for the S&P Index.

Vanguard went into 2008 with $2 trillion in assets under management (AUM). Rather than cutting back like all of its competitors, it had no layoffs and actively invested in new top-line growth initiatives. As a result, it now has $5 trillion in AUM, trailing only Blackrock at $6.5 trillion, and far outdistancing itself from Fidelity, Schwab, State Street, and TIAA.

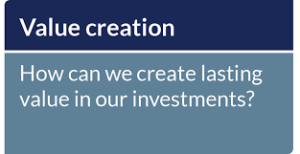

Using the 4 Zones Model to segment and prioritize value creation investments

The 4 Zones Model provides a framework, vocabulary, and decision-making process that enables senior leadership teams to discuss, segment and prioritize multiple value creation investments as shown on the slide below. It also allows them to successfully deploy digital technologies as a primary driver of sustainable market differentiating results. It ultimately serves as the strategic foundation for the company’s successful business model transformation into a digital enterprise.

This segmented portfolio of value creation investments is designed to change and significantly increase the value a company delivers to its customers, employees, supply chain partners, and other key stakeholders. It includes investments:

- To improve the productivity and efficiency of its cost centers and support functions in the Productivity Zone

- To modernize its operating model to deliver more compelling and enduring customer experiences in the Performance Zone

- To increase its speed to market & time to value to develop and deliver new products and services that leverage digital technology in the Incubation Zone

- To successfully scale material new lines of business and to leverage digital technology to enter attractive adjacent markets in the Transformation Zone

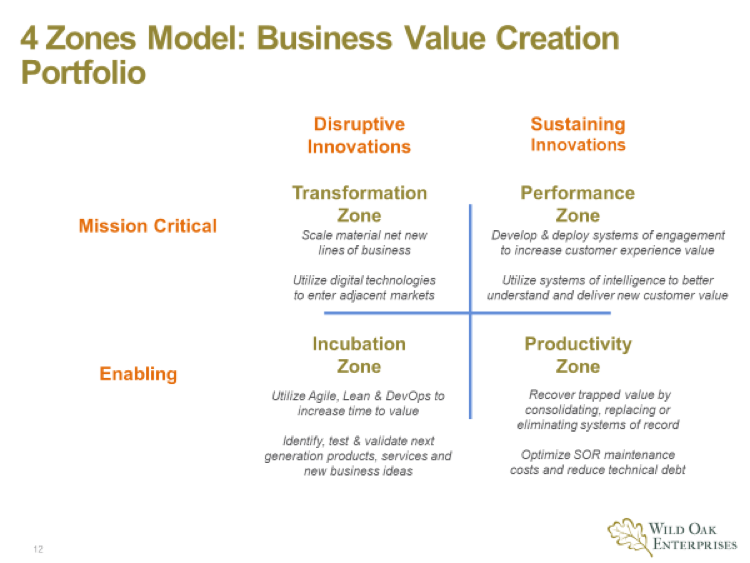

Productivity Zone: Value Creation Investments

The primary role of the functions in the productivity zone including Finance, IT, HR, Marketing, Customer Service, Legal, Procurement, Compliance, and others is to enable the company’s operating businesses in the performance zone to meet or exceed their revenue, margin, and net profits goals. A big mistake companies make in this zone is to equate cost reductions with value creation.

Before you initiate across the board budget cuts, exhaust the full potential of the trapped value recovery program. The goal of this program is to recover scarce resources, budget, and capacity from low value activities and reinvest them in high value activities as shown on the slide below. When done fully and effectively, it significantly increases the ROIC of all the processes and systems of record needed to operate the company.

Performance Zone: Value Creation Investments

Much of the value creation in this zone comes from utilizing new systems of engagement and systems of intelligence to deliver exceptional customer experiences. Depending on whether you are a B2B or B2C business, you will need to continuously evaluate how well you are engaging your customers using these new systems and tools.

Before you start to evaluate and prioritize a portfolio of investments in the Performance Zone, clearly identify and agree upon the criteria – goals, values, and desired ROIC – you will use to make those decisions. This criteria should be consistent for both short and long term decisions.

For example, Apple brought its first version of the iPod to market in 2001 in the midst of a recession that saw the company’s overall revenues decline by 33%. Steve Jobs and his leadership team believed the iPod could transform Apple’s overall product portfolio and increased their R&D investments by double digits.

This led to the launch of the iTunes Store in 2003 and new iPod models in 2004. These were followed by the launch of the iPhone in 2007 and then the iPad in 2010 which helped catapult Apple to the highest market cap in the world in 2018.

Incubation Zone: Value Creation Investments

Success in this zone comes from being able to quickly and efficiently identify, test, and validate the ROIC potential of multiple next generation products, services, and ideas. The key investment performance measures should be speed to market and time to value.

The reason many early stage, venture backed companies disrupt well-established companies is because they outperform them in this zone. They are much better at failing fast and redirecting new investments to the next innovation opportunity.

Before you greenlight any new projects in the Incubation Zone, utilize both systems of engagement and systems of intelligence to know what your customers value and what they are willing to spend money on now. This allows you to structure your investments in a modular fashion that will scale faster and more effectively based on real time customer/market feedback.

Transformation Zone: Value Creation Investments

Value creation in this zone comes from prioritizing investments to:

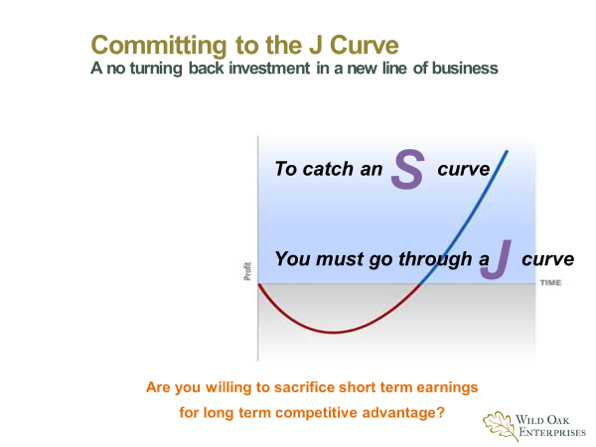

1. Launch and scale a material net new line of business: investing in a J Curve

In this case, the entire company including the Board of Directors has to make a “no turning back” investment and commitment to successfully bringing on the new line of business as the number one corporate priority.

This commitment to invest in a J Curve to get to an S Curve may take 24 months or more to generate the desired returns as shown on the slide below:

As such, the CEO and Board must exhibit strong leadership and resolve to stay the course until the new business has reached material revenues, margins, and profits. The target should be 10% or greater of the company’s current revenues, margins, and profits. Success also entails creating and communicating a compelling business case for investors that will support investing in the J Curve.

While it wasn’t into the face of a market downturn, in 2013 Adobe embarked on a major transformation for how they created and delivered value to their customers. The company shifted from their established product/license sales model and invested in a cloud-based software-as-a-service subscription model.

In the first year their $4 billion overall revenue declined 8% and it was flat in 2014. It started to rebound in 2015 and has grown to over $11 billion in revenue as of year-end 2019.

2. Utilize digital technology to enter adjacent markets: investing in asset deployment vs. asset ownership

In the second case, the emergence of new waves of digital disruption including cloud, mobile, social, data analytics, and smart devices exponentially broaden the investment opportunities to use digital technology to create multiple pathways to adjacent industries and new markets.

Historically companies believed that owning assets was the key to creating sustainable competitive advantage and building high barriers to entry into their markets and industries. Today as Uber and Airbnb among others have taught us, deploying digital technology with its widespread connectivity to leverage existing underutilized assets is the new business model for profitable growth. Without having to spend their capital to own assets, companies can access and deploy incremental adjacent assets at minimal marginal costs.

In addition, replacing high cost physical assets like data centers with investments in pay as you go web services from Amazon, Microsoft or Google can dramatically lower the cost of entry into adjacent industries and new businesses.

Utilizing this new investment model approach also opens up opportunities for companies to start offering their products as subscription services such as:

- Gillette On Demand & Dollar Shave Club

- Spotify, Netflix and Hulu

- Adobe, Salesforce & Workday

- Atlas Coffee Club, Stitch Fix & Hello Fresh

The subscription e-commerce market has grown more than 100 percent a year for the last 5 years.

To excel at value creation in a market downturn requires an investment framework, vocabulary, and toolset that lets senior leadership teams segment and prioritize a portfolio of different investment opportunities that are aligned with the different ways a company creates value. Early adopters of our 4 Zone investment model have found it to be a valuable resource and set of investment criteria to achieve market leading ROIC and exponential growth outcomes.

As always, I am interested in your comments, feedback and perspectives on the ideas put forth in this blog. Please e-mail them to me here. And, if this content could be useful to someone you know please share it here: