July 30, 2025

In the digital world,

business value creation is defined by long-term power not short-term performance

Are you liquidating your company’s long-term power to grow?

In a time of unprecedented change, uncertainty, and disruption, there is a strong tendency for senior leadership teams to focus solely on short term challenges and issues rather than longer term business value creation opportunities. The big “aha” moment comes for senior leaders when they realize that short term performance consumes long term growth. This means that if the company continues to overweight investments in current businesses to deliver short-term performance, it will eventually liquidate the company’s long-term power to grow.

To shift traditional thinking about what it takes to create sustainable business value, senior leaders need a framework and set of decision-making processes that free their company’s future from the pull of its past.

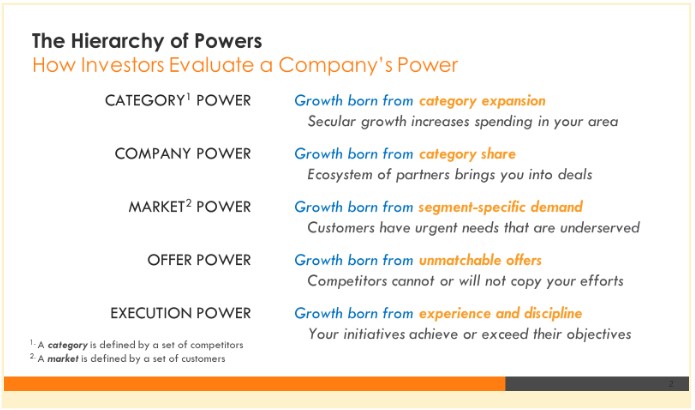

In his earlier book, Escape Velocity, my brother, Geoffrey Moore, developed the 5 stage Hierarchy of Powers framework to help leaders achieve this business value creation necessity.

The Hierarchy of Powers Framework

This market-proven framework enables senior leaders to evaluate their company’s long-term business value creation opportunities at five different levels. Each level amplifies the tradeoffs between investing in short-term performance vs. long-term power as shown on the slide below:

Let’s take a look at each individual level and explore the decision-making tradeoffs for each one.

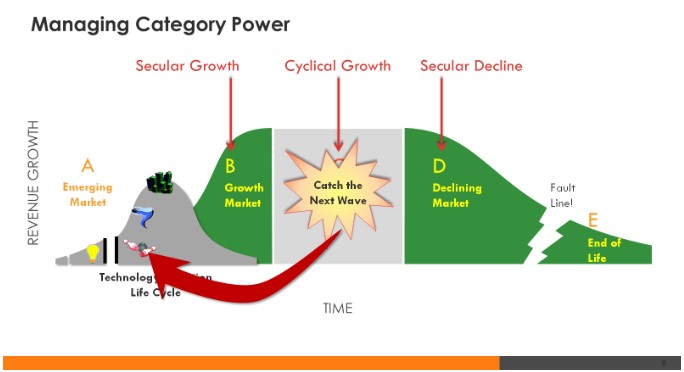

Category Power: Growth born from category expansion

Business value creation is virtually impossible to sustain if your company is doing the majority of its business in a declining category. To avoid that, senior leadership teams must continually assess and evaluate whether growth from their categories is expanding, contracting or staying flat.

Using the Category Lifecycle chart below, here are some questions to guide that assessment process:

- Where do your categories fall from A to E?

- What are the specific growth rates for each category you’re competing in?

- Which of your categories are vulnerable to digital disruption?

- Which of your categories are candidates to exit?

- Which of your categories merit increased investment?

This is the level at which you make the “big bets” on future growth, many of which will be designed to catch the next wave of digital technology that will deliver sustainable business value creation.

Two mistakes you want to avoid at this stage are:

- Making more than one big bet at a time

- Continuing to compete in a legacy category that is clearly in decline

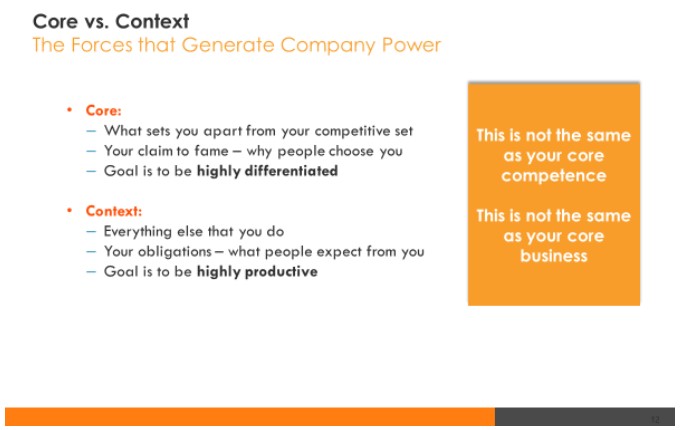

Company Power: Growth born from category share

While there are multiple sources of company power, the primary source is the ability of the senior leadership team to allocate more resources and budget to mission critical “Core” business value creation activities instead of non-mission critical “Context” activities as defined on the slide below:

Here are some questions to guide this assessment process:

- What are the sources of our company’s business value power today?

- How sustainable are those sources of power?

- What is mission-critical core for our company?

- How much of the company’s value is trapped in context activities?

- How can we recover that trapped value and redeploy it against core activities?

At this level you want to achieve alignment and commitment across the entire senior leadership team, with a mission to decrease the allocation of resources and budget to context activities and increase them to core activities that deliver long-term business value creation.

Two mistakes you want to avoid at this level are:

- Defining core as improving the last best version of the old business value creation model instead of creating the first best version of the new business value creation model

- Allowing underperforming legacy businesses to avoid the trapped value recovery process

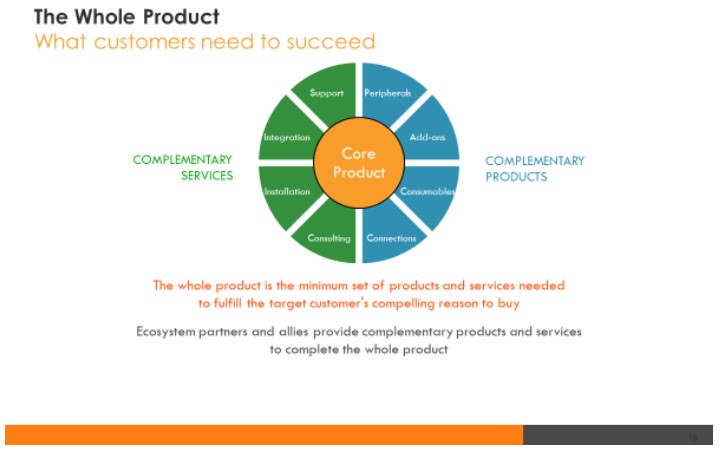

Market Power: Growth born from segment-specific demand

The primary source of market power comes from a company’s ability to create and sustain significant/dominant market share in a specific market segment. They achieve this market share by delivering a whole product, service, or solution that meets the target customers’ compelling reason to buy and who reference each other while making purchase decisions.

The other component of market power is generated by the company’s ability to assemble and manage an ecosystem of business partners and allies who each contribute additional components of the whole product that increase its business value creation potential and competitive differentiation as shown on the slide below:

Here are some questions to guide this assessment process:

- Where does the company have market power today?

- How sustainable is that market power?

- What adjacent high potential growth markets could we target?

- How can we effectively utilize our business value creation skills and capabilities to increase our market power?

Two mistakes to avoid at this level are:

- Trying to gain dominant market share without offering a whole product, service, or solution

- Not having a well thought out and documented go-to-market game plan

Offer Power: Growth born from unmatchable offers

In an environment of multiple waves of digital technology disruption, companies that can’t innovate unmatchable ideas, products, and businesses in real time will not be able to sustain long-term business value creation.

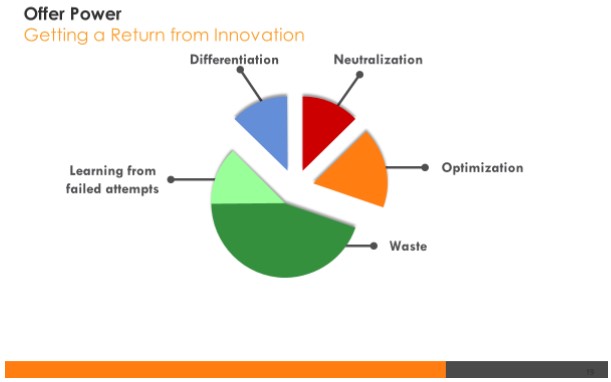

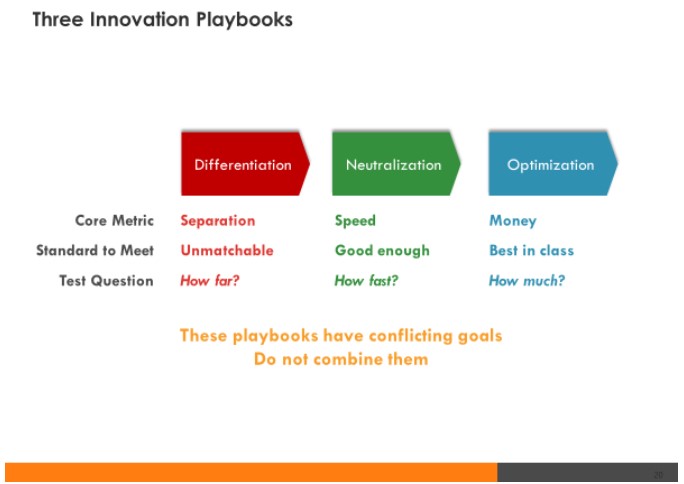

Multiple studies have documented that over 70% of new innovations fail to achieve their desired outcomes. The biggest source of that failure rate is companies who treat all innovation initiatives the same. In our work with innovation teams over the past 15 years, we have seen first-hand that when you segment innovation into three categories, as shown on the slide below, your success rate goes up exponentially.

Below are the three innovation playbooks we’ve developed and how they differ from each other:

Here are some questions to guide this assessment level:

- How unmatchable are our mission critical business value creation offers today?

- How sustainable are those offers?

- How well have our offers kept up with next-generation offers?

- Where are we wasting innovation resources today?

Here are two mistakes you want to avoid at this level:

- Not differentiating far enough to create an unmatchable offer

- Not moving fast enough to neutralize a competitor’s disruptive offer

Execution Power: Growth born from experience and discipline

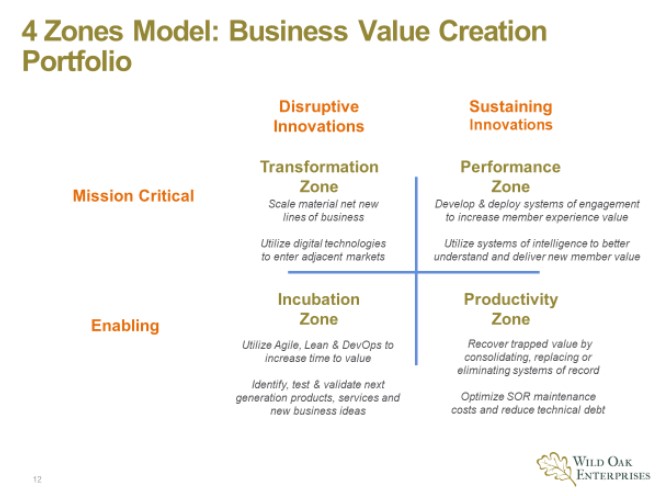

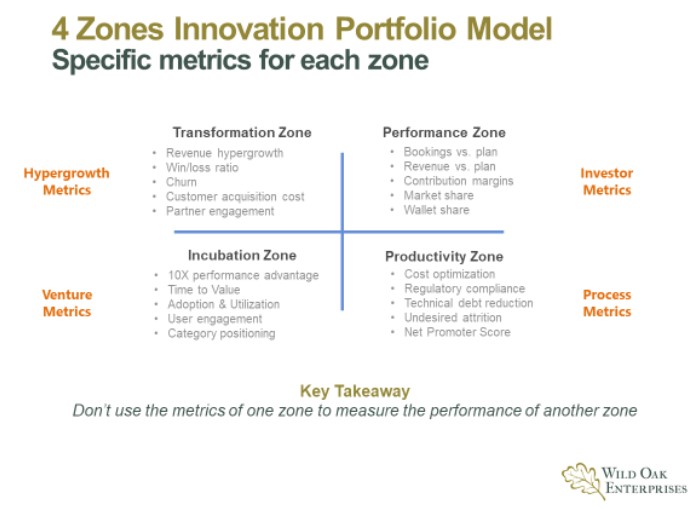

Successful execution power comes from finding the right balance between funding the businesses you have and making asymmetrical investments in new businesses that will increase your long-term business value creation power. The C-Suite leaders I’ve worked with have found the 4 Zones Model: Business Value Creation Portfolio, shown on the slide below, to be a very effective framework to segment and prioritize resource and budget investments that are closely aligned with the company’s business growth goals and financial metrics.

Here are some questions to guide this discussion:

- Should we do it? Does it align with and support our business value creation outcomes?

- Can we do it? Do we have the relevant skills, capabilities, and tools to achieve the desired outcome?

- Did we do it? Do we have the right metrics to measure the achieved outcome vs. the desired outcome as shown on the slide below?

Two mistakes you want to avoid at this stage are:

- Using the metrics in one zone to measure the performance in another zone

- Doing more than one transformation zone initiative at a time

To successfully prioritize long term power over short term performance requires a market proven framework, vocabulary and toolset that enables senior leadership teams to segment a portfolio of different business growth investments that are aligned with the different ways the company creates sustainable business value creation.

Practitioners of the Hierarchy of Powers and 4 Zones frameworks have found them to be a valuable resource and set of investment criteria to achieve market leading ROIC and exponential growth outcomes.

|