February 26, 2020

In the digital world,

IT should be run as a profit center, not a cost center

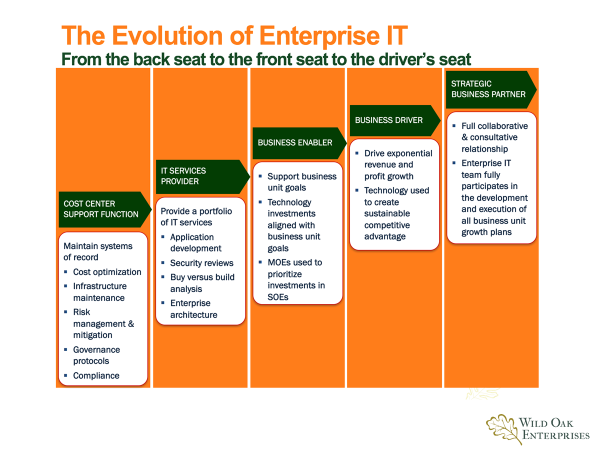

The evolution of IT from a cost center to a profit center is at the core of successful business transformations. The wave of new digital technologies are the driving force of new product and service innovation that is redefining how companies engage with their customers, employees and other key stakeholders. These companies treat IT assets as strategic business assets that are recorded as revenue generating or profit enabling.

Increased corporate profits are directly related to a company’s ability to leverage digital capabilities and have resulted in margin and profit growth that is 2 to 3 times faster than average.

The evolution of IT from cost center support function to profit center

For IT to evolve into a profit center, it has to free its future from the pull of its past. It has to overcome legacy mindsets and behaviors:

- 40-50% of CEOs and Boards still see IT as a cost center not a revenue generator

- IT still spends 80% of its resources and budget on running the business and only 20% on growing the business

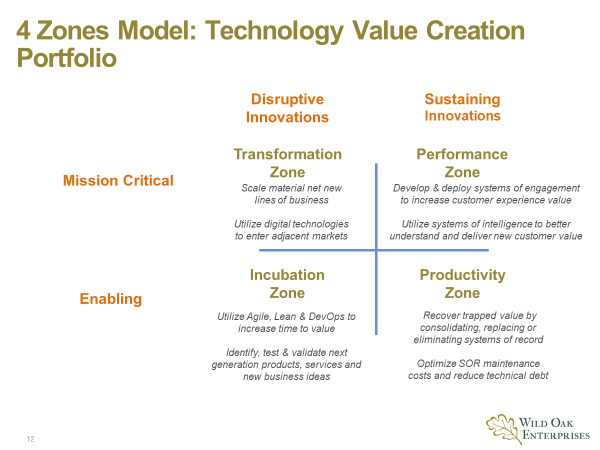

IT needs to confront these legacy mindsets and behaviors head-on and generate specific use cases that demonstrate the multiple ways digital technology delivers increased revenues, margins, and profits as shown on the 4 Zones chart below:

Here are some core questions to start IT’s evolutionary journey to a profit center:

- How does our company create value today?

- What could dilute or disrupt that value?

- How can our company deploy digital technology to drive new value creation?

Stepping up to the profit center challenge

To free IT’s future from the pull of its past, the ultimate goal is to run IT as a line of business with its own P&L statement. While this may be a challenge for many companies to embrace, here are some very compelling examples from a few that are making this transition:

Union Pacific railroad created and launched PS Technology, a separate commercial technology business, to sell digital technology apps the company originally developed for its own use to partners and competitors. As a result, they are now one of the largest providers of locomotive simulation systems which has generated $50 million in new revenue.

Raytheon has moved from using software as a business enabler to treating it as a new business growth opportunity. Starting back in 2007, it began partnering with and acquiring cybersecurity software companies. It created a new business unit with its own P&L called Forcepoint in service to CEO, Tom Kenney’s vision that “with the Internet of things, cyber is pervasive in everything we do, the entire globe has become essentially a cybereconomy.”

Intel used new systems of intelligence to forecast the right product mix and customer demand to drive $265 million in revenue uplift over the previous two years. They deployed new systems of engagement to customize their reseller customer engagement process to deliver 2500 new customers and $200 million in incremental revenue.

Monsanto developed and launched a data analytics platform called science@scale to run simulations against millions of data points on seed genetics, climate, water, soil and nutrients. The platform leverages Amazon Web Services and Google’s Tensor-Flow machine learning application to reduce the time to run simulations from months to minutes thereby increasing revenue by $17 million.

Amazon Web Services posted net sales of nearly $10 billion and operating profit of $2.6 billion in the fourth quarter, representing nearly 67 percent of the tech giant’s entire operating profit.

Atticus Tysen, CIO at Intuit, and his team are measured by growth in gross new subscribers to the company’s software. IT manages the company’s marketing website and shopping cart with a SaaS offering. As he says, “the line between what is the product team and what is the IT team is getting blurry. So IT has to measure itself that way.”

The IT team at CUNA Mutual developed and delivered a loan application app for mobile devices. Using loanliner.com, credit union members have applied for more than $6.4 billion in loans through the mobile application and the volume continues to grow.

When Jeff Bezos bought the Washington Post in 2012 it had almost no IT department. Today it has over 250 people in the department and almost every new digital tool used by the newsroom and sales people have been created in-house. Over the last three years, digital ad revenue has seen double digital growth and now exceeds $100 million. Digital subscribers, negligible a few years ago now top 1 million. The company became profitable again in 2017 and has remained so through 2019.